Want Financial peace without tracking everything?

Rather than spending endless hours setting up a budgeting app, syncing bank accounts and tracking every penny, our simple approach is to help you manage your money, so it doesn’t manage you!

4 Bite Budget is knowing where your money is going, and when it needs to go there so bills are covered and you are free to spend the rest!

(Having financial peace will be worth every minute and the spare change you paid to get it.)

THE UN-APP WAY TO EASILY MANAGE YOUR MONEY!

You don’t need another app! We’ll give you a couple of cool tools and then show you how to maximize your money using the app you already have with your bank!

Power Up Your Bank App!!!

Most apps focus on tracking your spending which is useful for understanding where your money went. But to get control of your money, you need to know where it’s going! The difficulty with apps is the requirement of entering every transaction and keeping it reconciled to your bank accounts.

Use the bank app you’re already comfortable with! 4 Bite Budget will guide you with our tools to plan and move money where it needs to be, giving you the freedom to spend without tracking everything.

Bank apps already let you:

- Transfer money between accounts

- See current account balances

- Set up Bill Pay, auto transfers, etc.

- Categorize transactions

- Filter for various reports

All you need is your bank app and 4 Bite Budget to build and maintain a budget that is simple, and as easy to use as the bank app you’re already using!

Follow The Science

The science of psychology is a major factor in budgeting. This probably won’t surprise you, but most people don’t want to budget. If they don’t want to budget, they’ll surely grow weary of recording every transaction trying to keep a budget! Fidelity, the investment company launched a program called Fidelity Bloom based on a study done in May of 2022 that speaks to budgeting issues.

- 65% feel they should save more, but are so stressed about their finances–they avoid thinking about them.

- 59% cringe at the thought of checking their bank account balance.

- 51% don’t pay any attention to saving and spending, as long as they have money in the bank.

- 49% say they couldn’t cover an unexpected expense of $1,000.

The study supports the idea that separating your money into categories or buckets so you can see what is available to spend reduces stress and sets you up to be a better saver. Managing your money with 4 Bite Budget follows the science and keeps you living within your means so you can eliminate stress and debt.

Do You Spend Up or Down?

Between the science and the real-world chaos of managing money lies our attitude

towards spending it—we either spend up or we spend down.

How Do You Spend?

The impact of how we think about and use money is staggering as evidenced by the findings of the Fidelity Money Mindset Study referenced in the Follow the Science section. The solution to financial peace is more money, right? Maybe, but if we are honest with ourselves, we all know people who are happy with very little money and people who are miserable with tons of money! Financial peace is more about being free of the man with little to no debt. Financial wealth is a whole different subject better left to financial planners and investors. 4 Bite Budget is a system that will help with managing your money and debt with the goal of replacing stress with peace.

So, if our mindset towards money is important, the answer to how you spend what you have is paramount to your success in having peace and even wealth financially. We all have different thresholds for savings, debt, risk, spending etc., but ultimately, we either spend up or down.

Spending up is credit based—you spend up to a limit.

That limit may be a budget amount you’ve set, or it could be the credit limit of your card(s). This works well if you are disciplined with your money and stay within your budget. But if you are spending beyond your budget because you have credit available, you are adding debt to your financial picture. Even worse, if you use one card to pay off another and another in a series of cash flow shuffling, you are playing with house money and if the bank calls the debt due—then what?

Spending down is debit based—you spend down from a limit.

The limit being spent from is based on how much money you actually have. If you don’t use the bank’s money, they can’t charge you interest, and they can never take anything away from you! That is empowering! Using a debit card means you are spending from an account you put money into which prevents you from spending more than you budgeted. In financial terms this is called zero based budgeting—what you spend is equal to what your earn. This isn’t always easy, but it’s the only way to get peace financially.

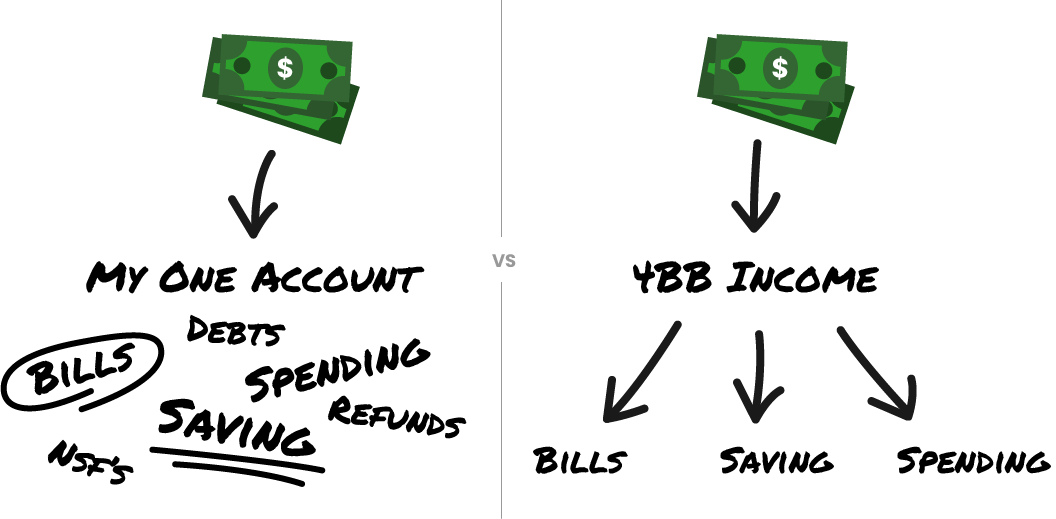

Turn Budgeting Chaos Into Financial Order

The 4 Bite Budget plan in a nutshell uses free checking accounts at your bank to deposit your income, allocate money for bills, savings and spending so you can break free of the all-my-money-is-in-one-account-and-I am-losing-my-mind-keeping-track-of-it-all scenario. Our easy to use tools will make

achieving a stress free, peaceful night’s sleep, a dream!

How Do You Do It?

The genius of 4 Bite Budget is you don’t have to track every penny to keep a budget. If you have separate accounts for things like bills and spending, then you just manage money to those accounts. Bills will be paid from the Bills account; you spend from whatever you have in your spending account—you get the picture. We’ll take this a little deeper into savings and income as you learn more about 4 Bite Budget.

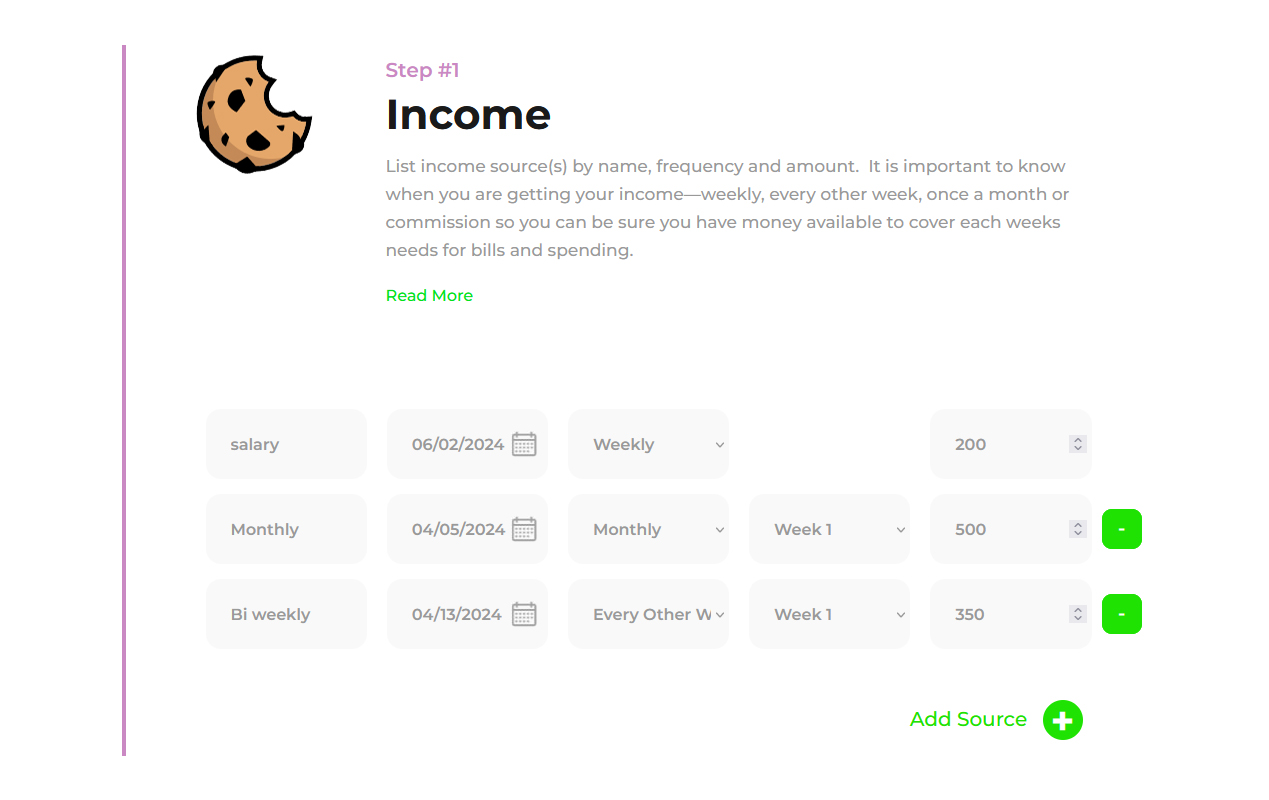

Interestingly, our name is derived from the idea of breaking budgeting down from one bucket with many categories that need to be reconciled in an accounting fashion to 4 simple buckets: Income, Bills, Savings and Spending. Can you eat a cookie in one bite? Sure, but it’s easier in 4 bites.

Get Your Peace

Eliminate the chaos and stress of budgeting. It’s as easy as making a plan, moving money and spending freely.

#1

Make a Plan

4 Bite Budget makes the first step of figuring out your money and putting a budget together simple by breaking your budget up into manageable pieces–eating a cookie in bites is easier than eating the whole thing at once! Wouldn’t you know, we have a Set Up tool we call The Recipe to walk you through the process.

#2

Move your Money

4 Bite Budget is like playing Monopoly where you’re the banker! Your dashboard will let you know exactly how much money needs to be moved from your Income account to your Bills, Savings and Spending accounts. Now you’re in control!

#3

Spend freely

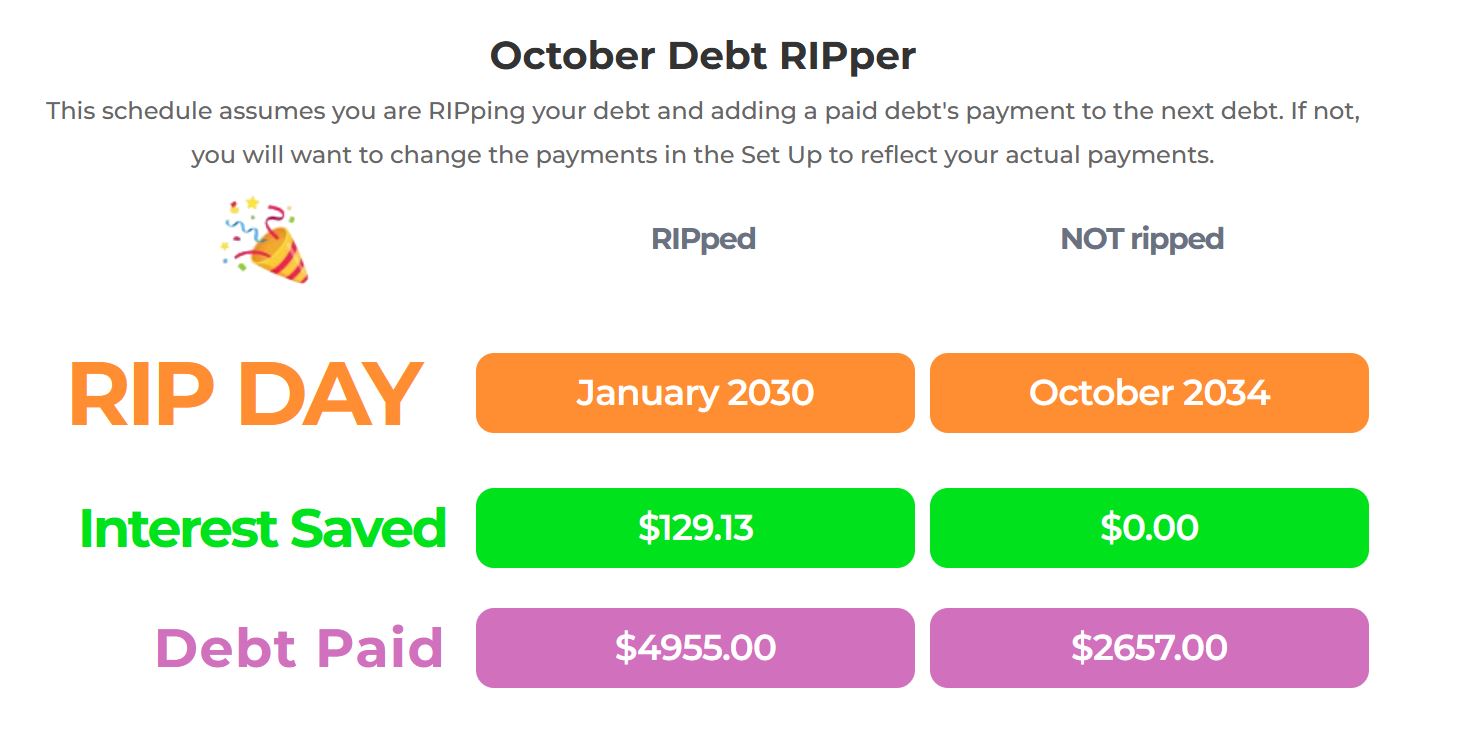

This is the beautiful part of 4 Bite Budget—without syncing to your bank or entering every transaction into an app, you are free to spend whatever you have in your spending account for the week! Bills are paid from your Bills account, savings are already in your Savings account, so you can relax. Heck, your debts are even getting smaller! What!? How you ask? Check out our Debt RIPper.

Testimonies

FAQ

Q: Why is 4 Bite Budget not an app?

- 4 Bite Budget is mobile responsive, so you can use it on any device.

- 4 Bite Budget is safer than an app because it isn’t connected to a bank and your data.

- 4 Bite Budget tools help you budget and manage your money using your bank’s app.

Q: Can I use a credit card—I want to earn points or miles?

The best solution is to use a credit card for bills and a debit card for spending. Bills are relatively consistent month-to-month, which would make your credit card bill consistent in your budget. Using a debit card for spending gives you the convenience of a card, but limits spending to what is actually in your account.

Q: Can I use cash—we are budgeting with envelopes?

Q: Is my data safe?

A: Perfectly safe. You will be planning a budget and entering dollar amounts, however, your financial account information is not synced to 4 Bite Budget, so there is no risk.

Q: Is it really just $9 a year after purchase?

A: Yep. 4 Bite Budget is a system with tools to help you set up and manage a budget with the ease of spending freely! This happens precisely because we aren’t having to write and update code that allows us to sync to financial institutions. That said, we do have hosting and coding updates that will be ongoing, so we figured less than one dollar a month was pretty reasonable.